This Week in Food Delivery & Quick Commerce (24/12/22)

Hi all,

Happy holidays from me. As always, primarily, I urge you to support the Ukraine humanitarian efforts.

Highlights:

Uber Eats & Meijer partner

If you have any questions or feedback, you can always reach me at alex.foodeli@gmail.com or on Twitter at @a_jordanov

I have a request:

If you like the newsletter, please consider sharing it and helping me reach wider audience that may benefit from it💬 Quote of the Week

“Company founders have entered into debt-focused deals such as bridge loans, structured equity, convertible notes, participating bonds and generous liquidation preferences. These moves are designed to avoid a dreaded “down round” — accepting funding at a far lower valuation than a company had previously secured. […]

As the market rout looks set to continue into next year, this person said that even founders of well-capitalised tech groups have had to ask: “What are the adjustments [we need] so we can live longer, how can we punt financing from next year into 2024?” […]

SoftBank-backed delivery app Gopuff raised a $1bn convertible note in March and has explored plans to borrow more since then, despite raising more than $2bn last year, which had boosted its valuation to $15bn by mid-2021.

These deals come with a conversion premium, which allows their backers to convert shares at a higher price than an eventual IPO. Such deals represent a bet that the company will trade higher after going public.

Convertibles “kick the can down the road”, said Chris Evdaimon, a private companies investor at Baillie Gifford. “They are mostly being led by existing investors who are saying we also don’t want to get into this unpleasant valuation discussion right now.” ”

Source: FT

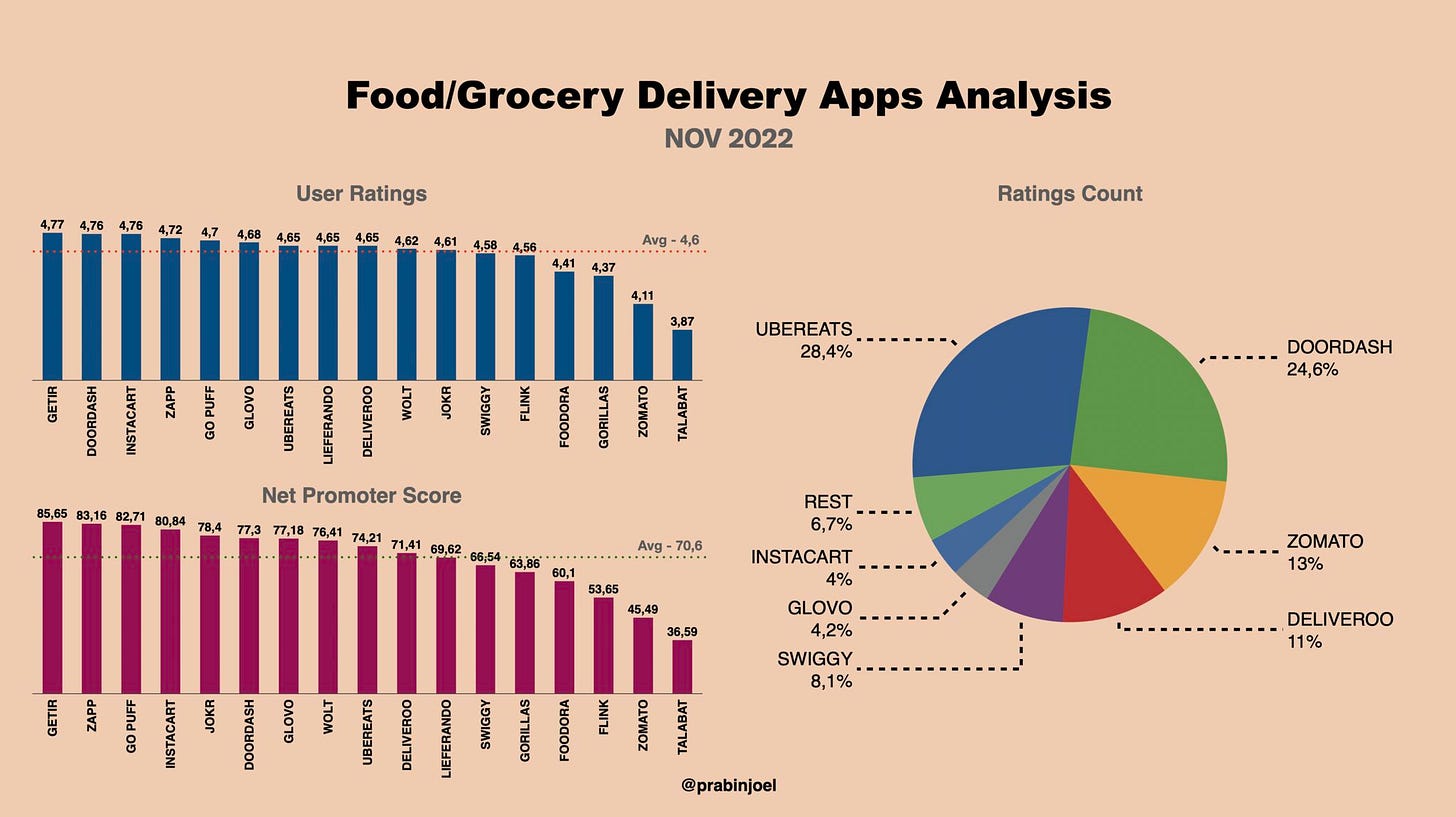

📊 Infographic/Stats of the Week

👉 Global Average App Rating: 4.6/5 | NPS: 70.6 --> Companies with scores below these will have to put a lot of effort to improve their ratings. I've been tracking similar data for micromobility and most below the average went out of business.

👉 It is important to note that all food/grocery delivery companies are setting higher standards that it would take a lot of effort to be on the top tier.

👉 Getir is still the top rated in Germany (4.8 | 90) followed by Flink (4.7 | 78). Getir is also the top rated in France (4.9 | 92). In both France and Germany, Getir has absolute dominance, with others trailing far behind in NPS.

👉 In the UK, Gopuff is the top rated (4.8) and also has the highest NPS (85).

Source: Prabin Joel Jones

🚚 Deliveries

Deliveroo Launches Nationwide Partnership With McDonald's [Ireland]

Uber Eats and Cartken bring robot food delivery to Miami, Florida

Hong Kong delivery platform Lalamove doubles growth in Vietnam

🚀 Q-Commerce

Uber’s Meijer Partnership Expands Grocery Delivery to Drive Platform-Wide Sales

Zapp partners with Deliveroo for delivery across central London

Deliveroo HOP sees 106% rise in orders for Christmas essentials

Instacart Uses SNAP Delivery Discount to Woo Lower-Income Shoppers

Indonesia's Radius quits quick commerce, rebrands as Bakool in pivot to group buying

🍳 Dark / Ghost Kitchens

💰 Financing / Exits

Omani cloud kitchen KitchenomiKs raises $1.7 million Seed round

EatFood Pakistan raises $1 million pre-seed / signs a deal with Delivery Hero

💻 Other

Belgian court sides with Uber against driver seeking employee status

M&S and Waitrose fight it out for the shopping baskets of middle England

Domino’s digital director lays out vision to become ‘Netflix of food’

📜 Deeper reads

Silicon Valley start-ups race for debt deals in funding crunch

Quick commerce last mile delivery: Indispensable or superfluous?

Everything Must Go: The Inside Story of a Startup’s Sudden, Agonizing Collapse

Grubhub and Technomic release new data insights from independent restaurants

Deliveroo’s collapse costs parent company $19m as creditors paid back in full

Quick, personal, live and immersive – this is how e-commerce will be in 2023

DoorDash, Grubhub, Uber Eats: We Finally Figured Out Which One Is Cheapest

You’re on the free list for This Week in Food Delivery & Q-Commerce. To support us, please spread the word