This Week in Food Delivery & Quick Commerce (15/10/22)

Hi all,

As always, primarily, I urge you to support the Ukraine humanitarian efforts.

Highlights:

Getir reportedly to acquire Gorillas

Meituan mulls first global push as China growth slows

Instacart Cuts Its Valuation for a Third Time to $13 Billion

Deliveroo does BNPL

Burger King, Popeyes, and Jack in the Box cut ties with Reef

US Federal gig worker proposal tanks Uber, Lyft and DoorDash stocks

If you have any questions or feedback, you can always reach me at alex.foodeli@gmail.com or on Twitter at @a_jordanov

I have a request:

If you like the newsletter, please consider sharing it and helping me reach wider audience that may benefit from it💬 Quote of the Week

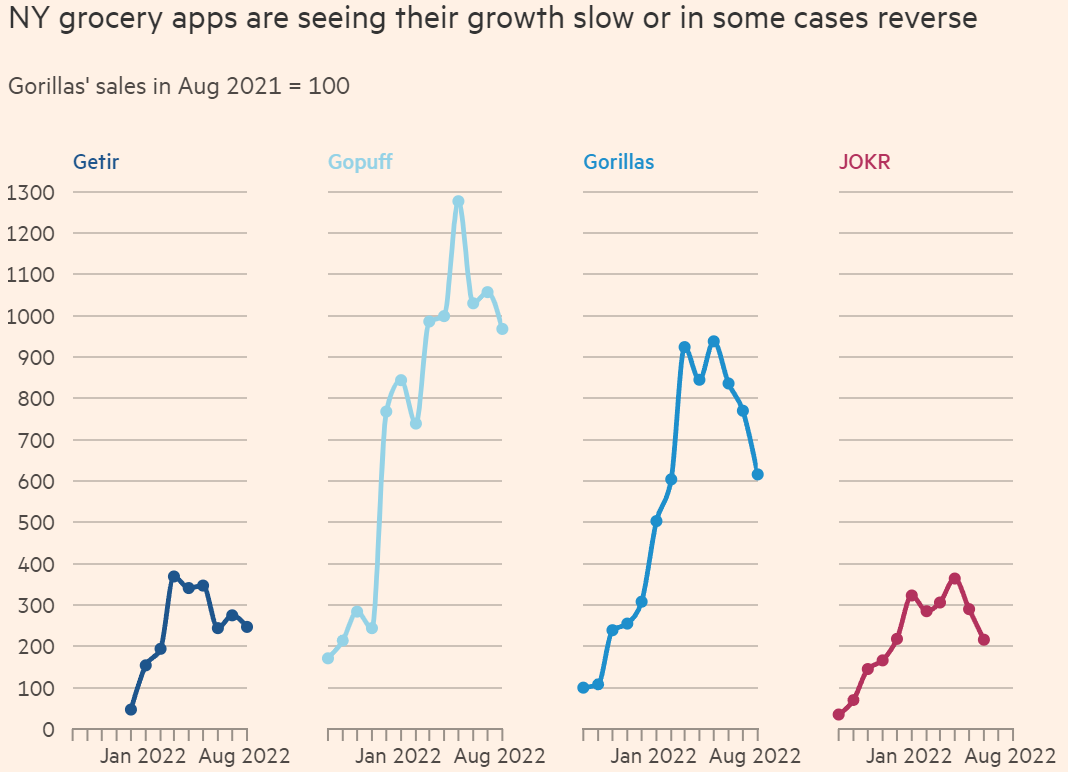

“Marketing spending averaged €8 for every single order placed by Gorillas’ customers in the first half of the year. It burnt more than €60mn a month in May, June and July, including what it described as “one-off” restructuring costs that repeated over multiple months. In total, Gorillas’ cash burn in the 12 months to July was more than €750mn, according to its presentation to potential admirers. Many who saw the figures believed it could not survive until the end of the year without new funding or a radical reduction in losses. “I don’t think any sane person would ever buy this company,” said one. ”

Source: FT.com / YipitData

📊 Infographic/Stats of the Week

Of the many companies to chase the rapid grocery crown, few went harder than Gorillas. Founded in Berlin early in the pandemic and led by former Bain consultant Kağan Sümer, Gorillas reached “unicorn” status — a valuation of $1bn — in less than a year, the fastest ever for a German start-up. In early 2022, as the number of its “dark stores” surpassed 200, Sümer planned to raise another $700mn. But that funding has yet to materialise and by the summer, Gorillas was cutting hundreds of staff and abandoning markets including Belgium, Spain and Italy. In May, Gorillas insisted it had “shifted our focus from hyper growth to a clear path to profitability”. Shortly afterwards, it began to search for a buyer. Figures from Gorillas shown to potential acquirers demonstrate just how costly that “hyper growth” had been. Over the past 12 months, it was, on average, losing more than €1.50 for every €1 it generated in net revenue, according to people who have seen the figures.

Source: FT.com / YipitData

🚚 Deliveries

Federal gig worker proposal tanks Uber, Lyft and DoorDash stocks

Marvel, DoorDash partner to highlight multi-skilled ‘Dashers’ in comic series

Seattle reaches $3.3M settlement with Uber Eats over gig worker pay violations

Delivery Hero offers new AdTech solutions in CitrusAd tie up

Domino's Pizza beats sales estimates as heavy discounts boost demand

Amid Delivery Pressure, Domino’s Drives 20% Increase in Pickup

Domino’s has sold 114 company locations in Arizona and Utah to franchisees for $41.1 million

In UK PizzaExpress signs delivery partnership with Just Eat and Uber Eats

Customers can order Deliveroo takeaways using buy-now-pay-later tool Klarna / Experts warn against using Klarna to pay for Deliveroo takeaways

Relish has signed an agency exclusive delivery deal with Deliveroo

Starship partners with Grubhub to bring sidewalk bots to colleges

Meituan’s Community Group Buying Platform Shifts Into Next-Day Supermarket Delivery Service

Gojek urges restaurants to make smaller meals cheaper as inflation bites

JD tests new group-buying service in renewed attempt to battle Pinduoduo and Meituan

🚀 Q-Commerce

Getir in exclusive talks to rescue rapid delivery rival Gorillas

Amid industry pressure, Gorillas is opening a giant distribution warehouse

Gopuff raises delivery subscription monthly fee for the first time

Investors shop for Ocado after talk of Kroger tie-up with Albertsons / Ocado shares jump over 10% on Kroger/Albertsons merger report

Boots UK announces 14 store rapid delivery trial with Uber Eats

Instacart Cuts Its Valuation for a Third Time to $13 Billion (used to be $39B in 2021)

Instacart Settles Worker Classification Suit for $46.5 Million

Instacart sharing when and where its workers can find peak earning opportunities

Amsterdam wants to force dark stores to move from neighborhoods to business parks

Yet another speed delivery store in Amsterdam ordered to close

PepsiCo Pakistan and Pandamart collaborate to promote Q-commerce solutions

Indonesian quick commerce firm Bananas is set to close its operations after launching in January

From click to brick in minutes: How Lego is tapping into “quick commerce”

🍳 Dark / Ghost Kitchens

💰 Financing / Exits

Crisp, an app-only supermarket focused on ultra-fresh food, raised €75 million

Co-living & smart food court firm Isthara raises $10 million to expand further into retail foodtech

Food delivery software startup klikit raises $2 million to expand across Southeast Asia

Foodini raises $700,000 AUD ($439,000) to match diners’ dietary needs with appropriate restaurant

Egypt-based delivery management solution Roboost has secured a six-figure Seed round

💻 Other

📜 Deeper reads

Who owns the biggest stake in Gorillas and what does a sale mean?

Will Getir gobble up Gorillas and how rapid grocery delivery is getting gory

Rapid UK Expansion For Fast-Delivery Grocery Franchise Getir

Still feeling good: The US wellness market continues to boom

Delivery Firms Boost Alcohol to Drive Loyalty and Increase Spend

Domino’s effort to fortress its U.S. market is running into a common problem: Construction delays

The next generation of ghost kitchens: 10 new startup concepts around the world

Domino’s Pizza Pops as Food and Drink Makers Parry Inflation

Delivery and takeaway numbers reach ‘all time high’ as customers tighten belts

The Rise and Fall of Ocado: Middle-England’s Favorite Grocer Suffers Share Price Drop

You’re on the free list for This Week in Food Delivery & Q-Commerce. To support us, please spread the word