This Week in Food Delivery & Quick Commerce (30/03/24)

Hi all,

The new edition of the newsletter is out!

Highlights:

Wonder raises $700M

Meituan had a good Q1

Ocado had a decent Q1

Instacart opens platform to 3rd party devs

If you have any questions or feedback, you can always reach me at alex.foodeli@gmail.com or on Twitter at @a_jordanov

I have a request:

If you like the newsletter, please consider sharing it and helping me reach wider audience that may benefit from it💬 Quote of the Week

“3 new unicorns in 2023 and 5 downturns

There are now 59 FoodTech unicorns, down from 62 last year. Even so, considering the context (the global amount of funding for foodtech startups decreased by almost 60% between 2021 and 2023), knowing that only five startups had their valuation decrease below the $1B threshold is almost surprising. Even better, three new unicorns (Zepto, Restaurant365, eFishery) appeared in 2023, and one (Inari) in the first quarter of 2024.”

Source: DigitalFoodLab

📊 Infographic/Stats of the Week

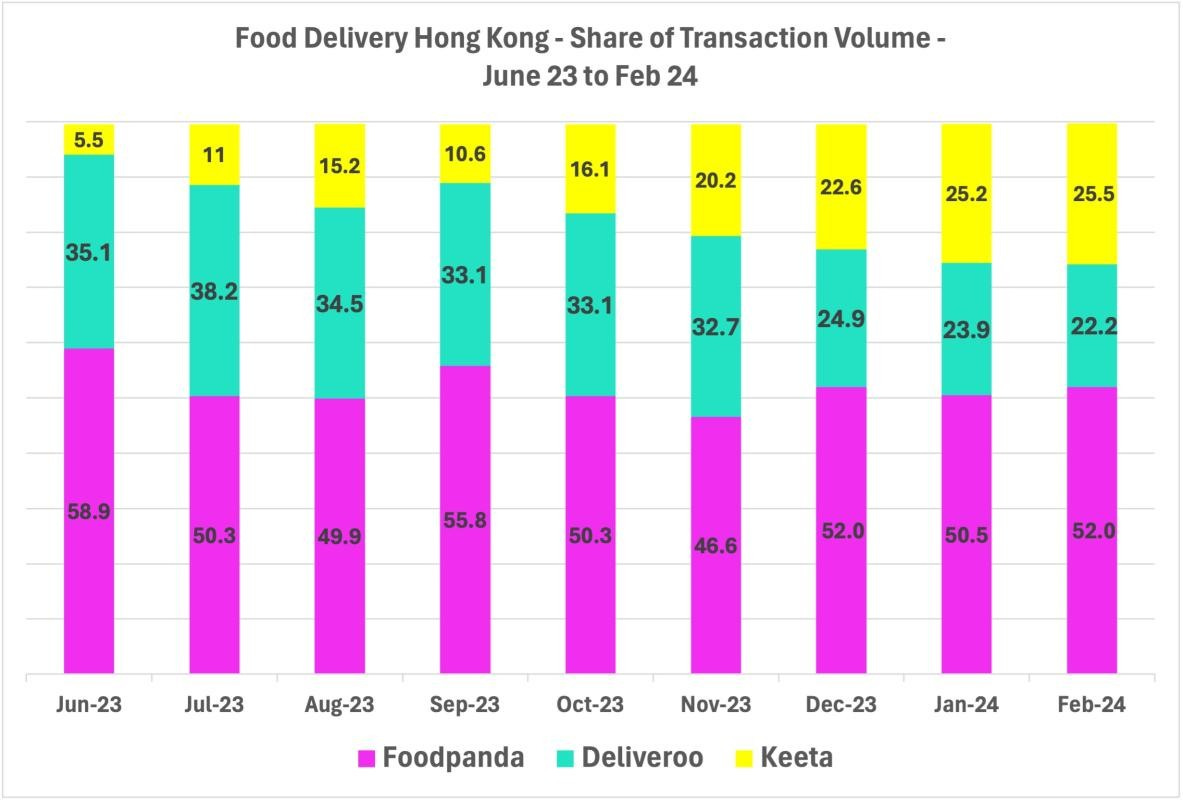

Having launched in only Yau Tsing Mong in Kowloon on May 19th 2023, KeeTa is now available Hong Kong wide since October. They can now claim to take slightly more than 25% of all transactions having gradually grown share month by month.

Food Panda had the most to lose from KeeTa’s launch; The laws of growth tell us that the market leader is likely to lose users in proportion to their share. However the good news for parent company Delivery Hero is that share remains consistently above 50% of transactions. The secret has been sustained penetration growth, with the brand capturing more consumers as the market expanded with KeeTa’s arrival

Deliveroo clearly has taken the biggest hit from KeeTa’s launch.

Averaging 35% share mid 2023, they now average around 24% in the last 3 months, with transactions only remaining consistent overtime, rather than seeing growth.

Source: Eureka AI

🚚 Deliveries

Wonder, Marc Lore’s Food-Delivery Startup, Raises $700 Million

Delivery Hero repurchases convertible bonds due in 2025 and 2026

Deliveroo is spending an estimated $230,000 to give a handful of riders 15 hours of childcare

DoorDash is testing drone delivery at a single Wendy's location in a small Virginia town

DoorDash Poaches AI Startup Talent to Bolster Voice Ordering

Bolt Business Launches Bolt Food for Business to help Companies and Employees Order Meals and Snacks

Chinese Food Delivery Group Meituan Sees Revenue Beat Expectations // Meituan Revenue Beats Estimates After Staving Off ByteDance

Coupang Eats to remove delivery fees for Wow members in attempt to topple Baemin

Pay to work: Rappi now charges delivery drivers in Brazil a weekly fee

🚀 Q-Commerce

Kroger Closing 3 E-Commerce Fulfillment Facilities // Kroger closing Ocado 'spoke' locations in Florida, Texas

Instacart wants to be everywhere, from smart fridges to New York Times Cooking

Instacart settles over alleged labor violations for nearly $750K

Ocado, M&S still talking over final Ocado Retail payment, says jv CEO / Speculation over M&S Ocado split persists after payment dispute

🍳 Dark Kitchens / Micro Kitchens / Virtual Brands

💰 Financing / Exits / Acquisitions

Wonder, Marc Lore’s Food-Delivery Startup, Raises $700 Million

Binny Bansal’s Three State Ventures Injects $25 Mn into Curefoods

💻 Other

Chinese e-commerce giants take on S. Korea with low prices and free shipping

Pennsylvania Domino’s pizza franchise fined $344,000 for child labor offenses

South Korea's Coupang plans $2bn expansion of next-day delivery

📜 Deeper reads

How India could become the world’s first quick-commerce success story

China’s ecommerce groups make inroads in South Korea with lure of low prices

The ghost kitchen industry is shrinking — here’s why that’s a good thing

You’re on the free list for This Week in Food Delivery & Q-Commerce. To support us, please spread the word