This Week in Food Delivery & Quick Commerce (17/02/24)

Hi all,

The new edition of the newsletter is out!

Highlights:

EU deal on platform workers falls apart

Instacart to cut 7% of staff, Q4 revenue misses estimates

Delivery Hero had a good 2023

DoorDash had a good Q4’23

Korea to curb expansion of Chinese e-commerce firm

If you have any questions or feedback, you can always reach me at alex.foodeli@gmail.com or on Twitter at @a_jordanov

I have a request:

If you like the newsletter, please consider sharing it and helping me reach wider audience that may benefit from it💬 Quote of the Week

“Online food delivery apps and ride-hailing groups were bracing themselves for a wave of rider and driver strikes in the US, Canada and the UK on Wednesday, in a dispute over pay at a time when the companies are under pressure from investors to push for higher profits.

[…]

In the US, Gridwise Analytics found Uber drivers’ average monthly gross earnings in 2023 dropped 17 per cent and DoorDash rider earnings nudged down 0.1 per cent, though Lyft driver earnings increased 2.5 per cent compared with a year earlier.

Based on aggregation of its user data, Rodeo, an app used by UK delivery riders to track and analyse earnings, estimated that the average pay per order on Just Eat had dropped 9 per cent to £5.59 and declined 2 per cent on Uber Eats to £4.21 in 2023, compared with 2022.

Those pay declines for drivers come as the companies seek to show investors they can consistently turn a profit, after years of sustaining heavy losses in a battle for market share.”

Source: FT.com

📊 Infographic/Stats of the Week

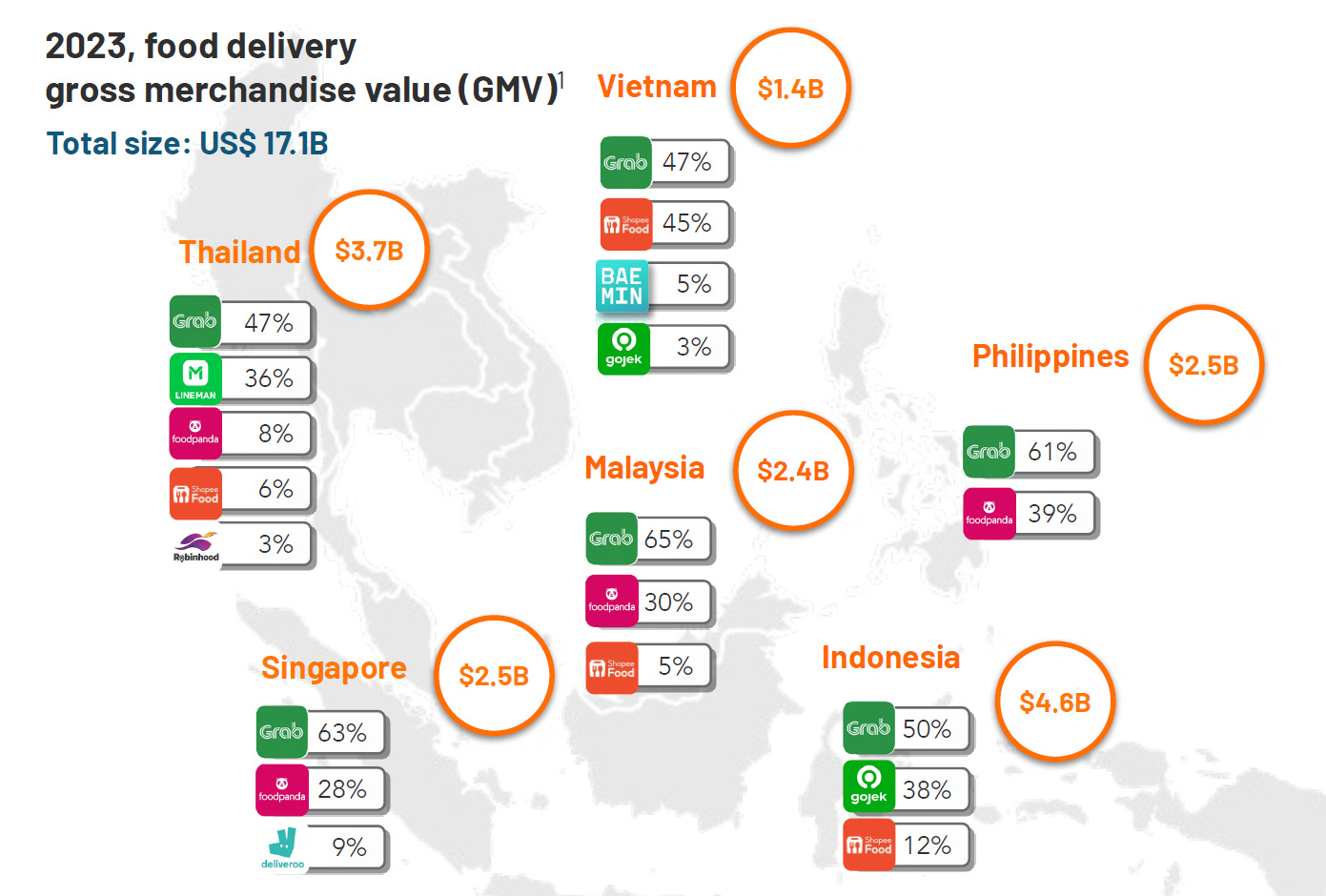

Most food delivery markets in Southeast Asia experienced very modest, low single digit growth, with the exception of Vietnam, where total GMV grew almost 30% espite cost controls from almost all the players

Source: Momentum Works

🚚 Deliveries

EU deal on platform workers falls apart, pushing law into limbo

Valentine’s Day strike to hit Uber, Deliveroo and Just Eat as workers unite over pay // Uber and Lyft drivers are planning a Valentine's Day strike

Uber Shares Surge After Unveiling $7 Billion Buyback in First For Ride-Hailing Firm

DoorDash's rising labor costs weigh on Q1 profit outlook, shares fall // DoorDash Stock Slides Despite Strong Earnings // Appetite for Delivery Drives Up DoorDash Revenue, Orders

Delivery Hero says cash flow generation enough to settle debt maturities //

Delivery Hero Might Not Sell Off Foodpanda In Southeast Asia After All

Mastercard Working with Glovo to Feed 300,000 School Children in Nigeria

Korea takes steps to curb rapid expansion of Chinese e-commerce firms

Food delivery sees first-ever transaction drop as Coupang, Yogiyo raise fees

China Market Update: March Of The Toreadors As Meituan Delivers

Zomato summoned over 'false practice' of food from 'iconic restaurants'

Swiggy’s Amazon-inspired playbook has restaurants crying foul

🚀 Q-Commerce

Instacart to cut 7% of staff, Q4 revenue misses estimates // Instacart to lay off 250 workers, part ways with 3 execs // Instacart Lays Off 7% of Staff Amid Rising Competition and Food Costs

Glovo’s Daniel Alonso Moreno: Q-commerce will drive growth for local retailers in 2024

Snappy Shopper partners with Co-op to enter Northern Irish market

🍳 Dark Kitchens / Micro Kitchens / Virtual Brands

💰 Financing / Exits / Acquisitions

💻 Other

📜 Deeper reads

The Future of Convenience Stores: Experience, Innovation, and Quick Commerce

Robots Are Coming, but Restaurant Automation Is Far From Easy

Delivering the Digital Restaurant: Revolutionizing restaurant delivery with automation and robots

Restaurant report shows breakfast delivery rising, as are wages and financing

Oscar Pierre: 'If Glovo had been acquired by any other large delivery company, I’d be out'

You’re on the free list for This Week in Food Delivery & Q-Commerce. To support us, please spread the word